Today wealth, and building wealth is about more than simply making money. We are now more than ever concerned with how to secure and protect the wealth we accrue over time. With the advent of the blockchain, and the inherent security features available in the blockchain, companies are beginning to look at how to make our real world assets more secure (and potentially cheaper to trade) through the process of duplicating an asset in the blockchain.

In this blog, we will deep dive into this whole concept of asset tokenization and what it implies for an investor and blockchain technology. We will also look at various sectors where it finds its applications in why there is a fundamental necessity for tokenization of assets on the blockchain.

What is Asset Tokenization?

Tokenization of assets, or simply put, asset tokenization is a process involving the transformation of assets on the blockchain. It includes physical as well as non-physical assets and applies to industries including finance, art, real estate, and health care. It is just the way of digitizing tangible and intangible assets and transforming them into tokens. However, a given acid is not necessarily equal to a single token as these are usually fragmented into smaller sections forming a whole token. The concept of asset tokenization has gained significant popularity in recent times. It is due to the advantages that a user gets after tokenizing their assets. It enables them to store and trade these tokens fractionally or entirely depending upon the requirements and preferences. Due to these advancements that a user gets, asset tokenization is probably on its way to becoming the next global trend in the field of Fintech.

What are the benefits of asset tokenization, and why is it necessary?

One may wonder if the concept of digitalization is new. However, there is a significant difference between traditional digitalization and asset tokenization on blockchain given its use. Precisely, retail investors and industrial sectors can derive immense benefits from the tokenization of assets which gives it a distinct identity. Here are a few reasons why asset tokenization is important in terms of the benefits it offers –

Improved liquidity

The first and foremost benefit of asset tokenization on the blockchain is better liquidity. It also helps in making the process smoother and more streamlined, which is not possible otherwise. It gives a platform to the users where they can create smart contracts to execute their transactions and ensure complete transparency. Users can easily sell off their tokens in the secondary market so that they don’t have to worry about early redemption and the costs involved. As a result of this, any individual or agency that holds a considerable net worth can easily invest and trade in private company securities. In the long run, agencies and individuals can also contribute towards the development of a better global market for trading and investing in private securities through tokenization of assets.

Better efficiency and automation

Tokenization of assets on blockchain uses smart contracts that are immensely helpful in automating the entire process. It reduces the role of intermediaries and takes away the burden of the involved cost. It also eliminates the need to invest extra efforts in regulating and administering the complete process that improves the overall efficiency.

Transparency

Tokenization of assets also provides better transparency to the user by enabling them to embed their rights and duties and defining the token attributes to reflect their ownership record. It enables the user to have a crystal clear idea of parties they are dealing with, involved terms and conditions, and source of purchase. This clarity and openness while dealing with transactions ensures better transparency in transactions.

Enhanced accessibility

Another great benefit of acid tokenization is that it provides better accessibility to the user. In addition to this, a user can also pregnant a specific part of an asset into as many tokens as possible. Consequently, asset tokenization also enables potential investors to gain ownership of the minimum part of shares in various investments. Due to this, any financial institution, business house, or retail investor can enter the field of asset management with sufficient relaxation in the investment amount and duration.

How is it different from securitization?

Blockchain technology allows you to issue a token as a digital representation of any eligible asset. It also allows you to perform any transaction with a single section of an asset. Owing to this convenience, many people confuse this process with securitization and asset tokenization. However, it is essential to understand that there are considerable differences between the two. Asset tokenization and securitization are entirely different concepts. Asset tokenization enables a user to transform anyone real-world asset into a digital token that provides a higher level of liquidity. On the other hand, a user can convert assets that carry low liquidity into security instruments with considerably higher liquidity through the process of securitization. Apart from this, another difference between the two is that tokenization allows you to convert these assets with different liquidity levels while you do not get the same option with asset tokenization. You get the option for trading in markets and over-the-counter deals using security tokens. Asset tokenization is also different from securitization in terms of the opportunities that it provides to the user. It enables the user to bring intermediaries to a single platform where different parties can perform trading and transact on the blockchain.

Types of token used in asset tokenization on blockchain

The different types of tokens used in asset tokenization on the blockchain can be classified into two broad categories depending on the nature and speculation. The first category of assets is divided based on their nature, which primarily includes tangible, fungible, and non-fungible assets. Tangible assets are those assets that hold a specific monetary value and have a physical form. On the other hand, fungible assets consist of tokens that have equivalent value to each other. Non-fungible assets carry a unique design and are not interchangeable. In addition to this, another category of asset tokens includes currency tokens, utility tokens, and security tokens. Currency tokens are representative of currencies in digital format while utility tokens are issued to raise funding for developing cryptocurrencies. These are later used for purchasing products and services being offered by the user issuing cryptocurrencies. Further, speculation-based asset tokens also include security tokens that represent traditional securities among various other cryptocurrency trends. These classes of tokens are most commonly used in acid tokenization through distributed ledger and blockchain technology. Hence, they find most of their use cases practical applications in various fields, which we will discuss in the next section.

Real-world use cases (applications) of asset tokenization

Tokenization of assets on blockchain also has several real-world applications where it helps the involved parties develop customized solutions for their industries. With blockchain technology gaining momentum across various industries, the growing relevance of asset tokenization helps these industries to develop smart solutions. Let us take a brief overview of how asset tokenization is helpful across various sectors. Here are the three most common use cases of asset tokenization on blockchain –

Real estate

The first and foremost use case of asset tokenization is in the real estate market. It can give rise to many new investment opportunities for both investors and financial institutions. It also becomes easier for buyers and sellers to interact with each other due to the absence of multiple intermediaries on the blockchain. Due to this ease of operation, there is a good possibility of improving the liquidity of real estate and opening it to a large number of investors in the market. Hence, investors can see real estate tokenization as a successful working mechanism for the market.

Finance

Asset tokenization also finds wide-ranging applications in the field of finance. It is due to the development in the financial technology industry that has been capitalizing through its resources on blockchain to reform the entire industry landscape. Asset tokenization on the blockchain can significantly contribute to transforming product and industrial structuring. It also helps financial organizations to make the exchange functionalities seamless.

Healthcare

The Healthcare sector is another use case where asset tokenization addresses some of the most critical challenges. It helps medical institutes to create healthcare solutions based on tokenization. These healthcare solutions further help in regulating the use of sensitive patient and healthcare organizations’ data by intermediaries and third-party organizations.

What is the existing scenario?

If we closely look into the current scenario of asset tokenization on the blockchain, it is apparent that financial institutions are identifying the opportunities. The total share of tokenized assets represents a comparatively lesser percentage of the total assets. The reason for this insignificant contribution is due to the market statistics as asset tokenization is in its initial stages of development. With reference to the findings, the current market size of asset tokenization on a global level surpassed 2.3 billion USD in 2021. It is expected to reach a valuation of 5.6 billion USD by 2026, with a total of 19.0 % compound annual growth rate during the entire forecast period. Financial institutions are expected to comply with the regulatory standards to address the challenges and ensure the safety of transactions. There is also an increasing need to reduce the risk of data and privacy breaches which can significantly influence the growth of the asset tokenization market globally. The global asset tokenization market is estimated to project strong growth in the future, especially in the Asia Pacific region. It is also likely to grow larger in its market size in the upcoming quarters, which is a good signal for investors and financial institutions promoting applications of asset tokenization.

What are the related risks and challenges?

Despite the available opportunities and increasing scope in digital assets, prospective students and investors still look forward to asset tokenization with caution. The reason behind this approach is directly related to the prospective risks and challenges involved in asset tokenization on blockchain. Here are a few issues that currently exist about asset tokenization on blockchain –

Legal and regulatory challenges

Owing to its borderless nature, blockchain provides many opportunities to individuals and businesses. However, real-world applications of asset tokenization face a different set of challenges about regulatory issues and existing technologies. Despite the availability of several opportunities, many countries have still not set common regulations applicable to administering asset tokenization.

Absence of code of conduct

Another serious risk associated with asset tokenization is the absence of a code of conduct and common standards. Since there are no common standards for the creation and regulation of digital assets, investors may identify the potential undesired practices. It may also force business houses to reconsider their business architecture and models. Therefore, it is necessary to implement a formal code of conduct and framework to improve the fundamental regulatory system and ensure harmony across market participants.

Security issues

Similar to other technologies, blockchain is also prone to online attacks and cybercrime. Although the rate of cyber attacks on the blockchain has reduced significantly in the past couple of years, it is still not satisfactory. There is a need to bring forth a comprehensive and reliable digital asset management system to manage the regulatory activities and provide protection against cybercrimes.

How Tokenization is impacting our world

Tokenization of assets on the blockchain has already gained momentum in asset management and numerous markets by making them safer and more democratic. It is no longer perceived just as a temporary solution but a revolutionary idea that holds the potential to transform the entire blockchain technology. Nowadays, a user can tokenize literally any asset, no matter if it is a tangible asset or intangible asset, physical investment, or a piece of art. It has opened a whole new world of opportunities for investors and individuals to perform their functions and participate in the blockchain ecosystem. No wonder why everyone has started seeing it with a lot of hope and expectations for a better tomorrow!

How LCX is dedicated to making your crypto and real world assets more secure

On 13th June, 2022, Monty Metzger CEO and Founder of LCX shared his thoughts, ideas, plans and prospects of Tokenization in the METAFORUM conference. He has been working on making everything tokenized for the benefits of the community. Thus, LCX was created as a solution for compliant digital assets and security tokens.

LCX is a secure and compliant platform for buying, selling, transferring, and storing digital currency.

In this conference he covered some major points related to Tokenization, like:

What is Tokenization?

Tokenization is the process of representing real world assets, a financial asset or other rights digitally on a distributed ledger in form of a token

Benefits of Tokenization

-Enabling Global Trade: Anyone from wherever, regardless of demographic constraints, will be able to purchase the tokenized asset.

– Fast and Cheap Settlement: By introducing tokenization into the ecosystem, high settlement and commission fees may be avoided because the process will be automated utilizing smart contracts.

– Unlocking Illiquid Assets: Illiquid assets can be tokenized and then traded on the issuer’s preferred secondary market.

– Fractional Ownership: Assets can be fractionalized to make them more accessible to small investors. Tokenization allows a broader group of investors to invest directly in digital assets, such as tokenized real estate.

– Automation: Through so-called “smart contracts”, numerous intermediate steps can be carried out automatically via the blockchain.

– Transparency: Transparency is the central feature of the blockchain technology and contributes to the increase in attractiveness of tokenization as an investment opportunity

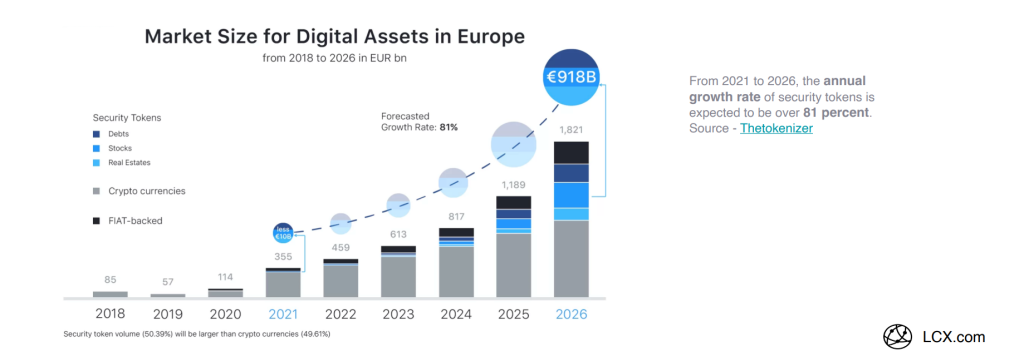

Moving further with the presentation, Monty Metzger shared some statistics that shows where tokenization will reach by 2026.

Increasing data security problems in all data-sensitive companies around the world are driving the tokenization market’s growth. The tokenization market has grown significantly as a result of a large number of financial institutions opting to increase security in payment processing systems. And the following stats speak to the facts.

By 2030, 25% of all securities, publicly listed securities, are going to be tokenized. That’s about 4 trillion USD worth of total issuance volume

You can raise millions in a Token Sale the Legal way through LCX.

LCX is registered as a “Token Issuer” according to Liechtenstein Blockchain Laws.

Fully compliant token issuance solution combining all legal and technology aspects

– Smart contract development

– Token sale legal documents

– Registration at regulator

– Investor on-boarding and KYC

– VIP investor support

– Secret access codes for private token sale

– Community push for public token sale

LCX has conducted successful Token Sale for companies like NFT-MAKER, Digicops labs and Envision Stock this year.

This number shows how companies are getting inclined towards tokenization and planning to launch their own tokens for the benefits of the community.

Not only this but the Tokenization market has reached NFT space and now diamonds can be traded as a part of it.

Tiamonds by LCX is the biggest live example for this.

Tiamonds is the largest blockchain-powered marketplace for diamonds NFTs worldwide.

– Proprietary technology platform launched and developed by LCX. Includes 6 smart contracts enabling trading, vesting and asset tokenization.

– Tiamonds NFTs are non-fungible tokens (NFT) representing the 1-1 ownership rights of real-world Diamonds.

– NFTs are 1-1 assets backed by certified Diamonds.

– Diamonds are certified by the Gemological Institute of America (GIA) and LCX certificates.

– Diamonds are physically stored in a high-security vault in Liechtenstein and are insured by Lloyd’s London.

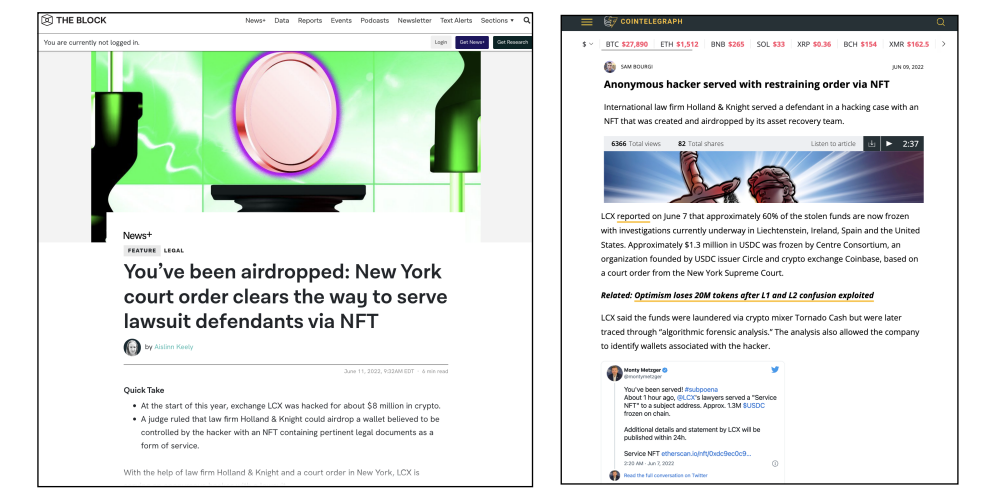

In the starting of the year 2022, LCX suffered from a hack and as a compliant and regulated company we worked to control the theft and make sure that it gets controlled. As a result of it tokenized court order as nft asset recovery of stolen fund; 60% frozen.

LCX achieved a historic milestone by freezing 60% of stolen assets:

– 1.3 Million $USDC had been frozen by Centre Consortium by NY Supreme

Court Order

– 500 ETH had been frozen at Coinbase Europe by Liechtenstein Court Order

The world of tokenization is now getting more accepted due to the increase in cyberattacks and data breaches. Security solutions (like tokenization) are in high demand, even in small and medium-sized businesses (SMEs). The global tokenization market is expected to expand growth during the forecast period, owing to rising demand for market surveillance.

Originally published via this site and this site

Although the material contained in this website was prepared based on information from public and private sources that LCXwire.com believes to be reliable, no representation, warranty or undertaking, stated or implied, is given as to the accuracy of the information contained herein, and LCXwire.com expressly disclaims any liability for the accuracy and completeness of the information contained in this website.

About LCXwire

LCXwire is dedicated to providing you the latest news about the products and services of the Liechtenstein Cryptoassets Exchange, the LCX token, and information relevant to the Centralized and Decentralized Finance (CeFi and DeFi) Exchanges. Our goal at LCXwire is to provide you with the best, most relevant and exclusive information about the crypto industry.

Follow us: Facebook I Facebook Groups I Linkedin I Twitter