The world of Decentralized Finance, or DeFi for short, has been a goal of the blockchain community for a considerable time. The concept of DeFi is to increase financial equality and accessibility for individuals throughout the world by using the strength and security of the blockchain. Current financial tool services and capital–efficient models are not readily available to the average investor. This has created a barrier to the average investor by making it difficult to invest in shares, commodities, or real estate. However, using asset tokenization on permissionless blockchain networks may provide the solution for lowering entry barriers and increasing efficiency in global markets. That leads us to the Mirror Protocol and mAssets.

What is a Mirror Protocol?

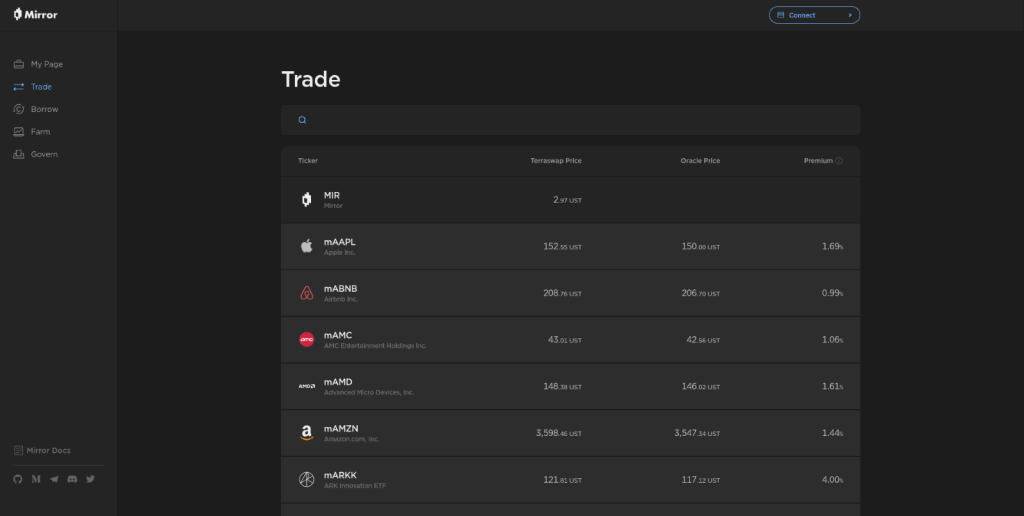

Mirror Protocol is a decentralized trading protocol that allows anyone to create and trade synthetic assets, allowing that individual to unite the world of traditional assets and blockchain in one place.

Mirror Protocol is a DeFi platform enabling users to create crypto tokens or synthetic assets that mirror the real-world assets’ prices.

The Mirror Protocol is based on the Terra Network, but its synthetic assets, known as Mirror Assets (mAssets), are also accessible via bridges on the Ethereum Network. The holders of Mirror Protocol’s native governance token, the Mirror Token, administer the protocol (MIR). Since Mirror Protocol works on the Terra blockchain it has a strong connection with the token LUNA and the stablecoin UST. Its operation in general terms is identical to what we can see in Synthetix, where investors can operate with assets that synthesize and reflect the value of another asset (hence the name Mirror Protocol or Mirror Protocol).

How does Mirror Protocol work?

An Example of a Mirror Protocol Investment

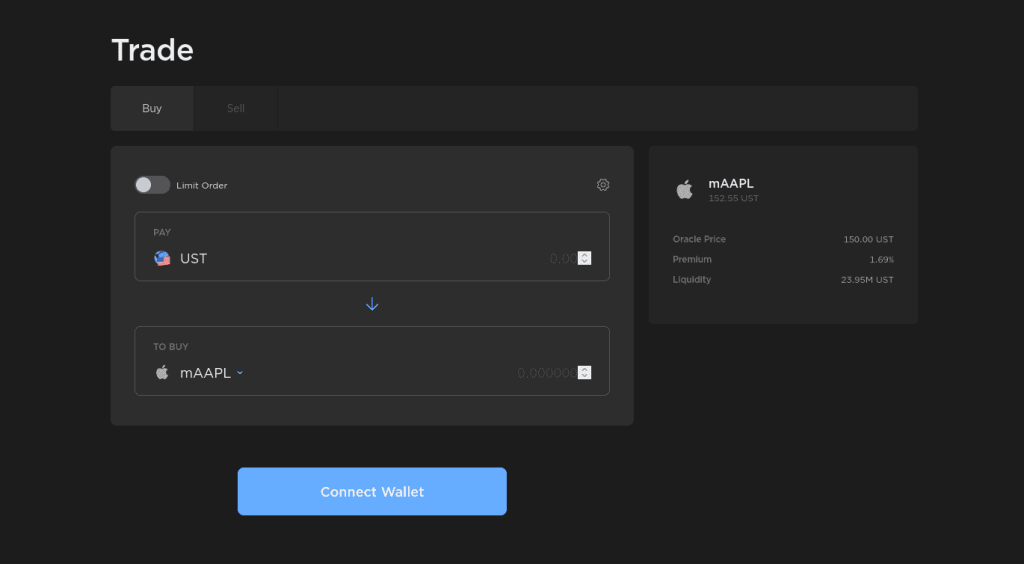

Let’s say an investor wants to buy Amazon shares but wants to make that purchase on a decentralized platform and outside of Nasdaq’s power. In this case, this protocol gives the investor an option and all they must do is go to the protocols website, and create a new mAsset with the name mAMZN (AMZN is the Amazon market name).

At this point, the investor injects the necessary liquidity for the creation of the mAMZN to be successful. This is because the creation of this mAsset responds to a staking collateralized within the Mirror Protocol, which upon completion generates a certain number of mAssets. The fact that the mAsset is overcollateralized helps to avoid its sudden fall due to the high volatility of the cryptocurrencies used in its creation. In this way, when creating mAMZN, the smart contracts necessary for the investor’s new mAsset to always reflect one thing: the real AMZN value on Nasdaq, all in a decentralized way.

If a crypto investor is looking for new markets to diversify their portfolio, looking towards assets like AMZN or other companies is a good idea. Although, these assets do not have incredible growth like many cryptos, their growth is usually very stable, with very good returns and less risk. In any case, this is a unique opportunity that brings the crypto world closer to the world of real-world stock market investments.

As you can see the possibilities are spectacular. Think for a moment if an investor can do the above with any company or asset within a real exchange. This opens the doors to new investment markets and, therefore, new ways of obtaining benefits or protecting them. Nevertheless, this protocol has that potential and makes it available to anyone on the planet.

What is an mAsset?

mAssets are blockchain assets that act as “mirrors” of real-world assets by reflecting on-chain exchange prices. Like any other cryptocurrency, it gives traders price exposure to tangible assets while permitting open access, fractional ownership, and censorship resistance.

Synthetic tokens provide access to the price of the real-world assets they represent to investors without requiring them to possess those assets themselves. As a result, traders who would ordinarily be barred from trading certain underlying assets can profit from these price fluctuations. For automated market makers (AMMs) like Uniswap or Terraswap, synthetic assets can be swiftly swapped by consumers for other synthetic purchases or stablecoins.

Who introduced mAssets?

The Terra Money team developed the Mirror protocol and eventually mAssets. Terra is a popular protocol in the DeFi and Cosmos Hub markets. The same team also developed Terra Core, Mirror finance, the LUNA token, and CHAI, a blockchain payment solution. The Terra team wants to use blockchain technology to eliminate all inefficiencies.

How does mAssets work?

To mint (or create) an mAsset, an investor must do the following:

- The protocol stipulates the first deposit of collateral be made (more than 150 percent of the current value of the real-world asset). Acceptable collaterals are mAssets and TerraUSD (UST), a stable coin minted by Terra.

- If the real-world asset’s value climbs to the point it exceeds the collateral value you deposited, your collateral will be liquidated to keep the system afloat.

- The investor must first burn the assets given to them to redeem their collateral.

- The investor may also trade mAssets on AMMs like Uniswap and Terraswap by interacting with liquidity pools.

- Though mAssets can be exchanged anytime, they can only be issued during real-world market hours (to match the equities and bonds that serve as their underlying index value).

Properties of mAssets:

- The underlying asset that the mAsset is designed to follow is identified by its name and symbol.

- Oracle Feeder provides the currently registered pricing. This is primarily used to calculate the CDP collateral ratio and has no direct impact on the mAsset’s Terraswap trading price.

- The auction discount rate specifies the discount for which a CDP (collateral debt position) scheduled for liquidation can purchase its collateral by paying the minted amount.

- They must report accurate and up-to-date pricing so that the mAsset’s trading value remains in sync with the reflected asset. Each mAsset has a designated feeder that can be transferred via governance.

Roles within Mirror Protocol

Of course, the previous example shows that in Mirror Protocol there are a series of well-defined roles, among which we find:

Minter

Minters are the creators of synthetic assets (mAssets). The main job of the Minter is to inject the necessary and overcollateralized liquidity to generate new mAssets.

Thus, for example, to create our mAMZN token (with a value of about US $ 3.500 per token / share), a minter must enter about US $ 4.025 in UST stablecoin (15% overcollateralization) or use US $ 5.250 in LUNA (50% overcollateralization) to create that new token. As you can see, it is the same mechanism that is used to generate coins as DAI in MakerDAO, and that overcollateralization helps to stabilize the price of the asset against the price fluctuations of the cryptocurrencies.

With the creation of the mAssets (mAMZN, in our example) it can be traded in Mirror Protocol, and at all times it will follow the price of Amazon’s share in the market.

Traders

Traders are all those interested in buying or selling the mAssets according to their need and strategy. Being Mirror Protocol, they can buy mAMZN tokens freely, without registration and in real time, exposing their money to a token that is a true reflection of the action they want to buy.

Liquidity Providers

Because Mirror Protocol is an AMM-type DEX, it needs liquidity providers to generate the liquidity pools necessary to create the exchanges made by traders. In the same way as in other DEX AMMs, liquidity providers receive commissions for each change made within the pool where they participate.

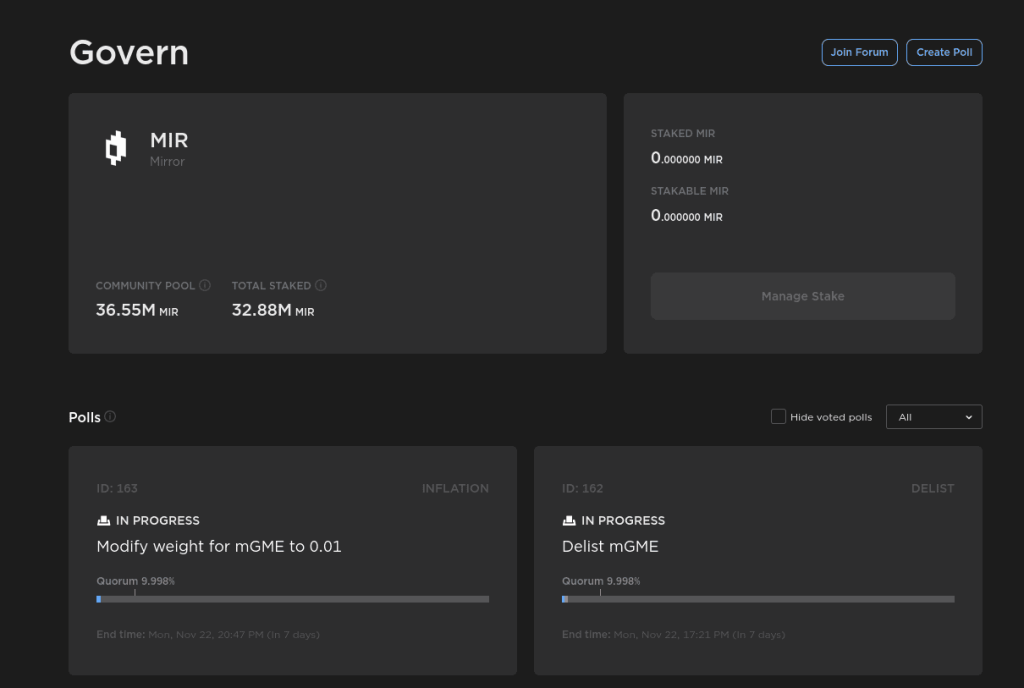

Stakers

Finally, there are the stakers which can be defined in two types:

- Stakers of the LP tokens, which receive Mirror tokens (MIR tokens) in exchange for their participation in the LPs.

- MIR Stakers, which earn commissions from CDP withdrawals. The CDPs are in charge of allowing the minters to generate the mAssets within the platform.

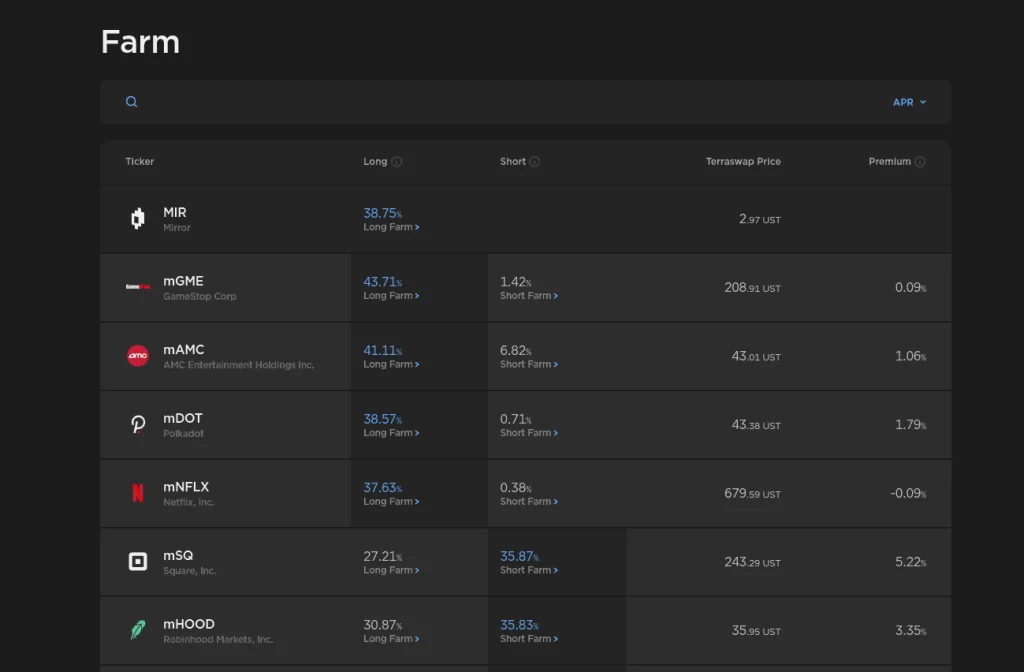

Farmers

Farmers in this case are those users who use Mirror to apply yield farming strategies. To do this, farmers must enter in a 1: 1 ratio both in the chosen mAsset token and its value in UST.

For example, a farmer in Mirror can take 1 mAMZN (worth 3.500 US $, at the time) and put it together with 3.500 UST to participate in the yield farming option within the Mirror. Through this strategy, farmers earn rewards for the positions held, being an option to generate passive profits on this platform.

MIR Token, the Mirror Protocol token

The Mirror (MIR) token is the platform’s native token, and its main function is to serve as a reward system for stakers and to be the token that measures the voting strength of its holders within the decentralized governance of the protocol.

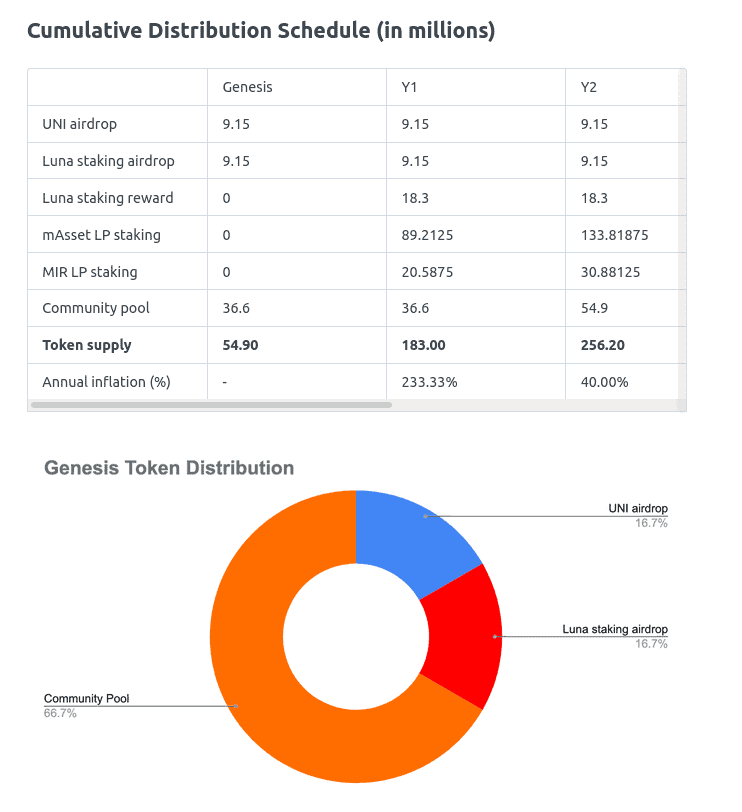

The MIR token is vital within the protocol and therefore the developers have decided to limit the existence of the token to a maximum of 370.575.000 tokens, in order to achieve its revaluation.

Coin performance

The coin rose soon after launch from $1.1433 on 16 December 2020 to $7.079 on 21 February 2021. It corrected soon after, however, dropping to $4.3946 on 28 February, before surging to record highs of $12.45 on 9 April 2021.

Soon after, MIR dropped to $3.52 on 23 May 2021, before rising to $4.5112 on 20 August 2021. It has since dropped significantly in value, falling to lows of $1.1061 by 23 February 2022.

The MIR coin stood at $1.68 as of 16 March 2022. Although the coin dropped by 77% during the past year (March 2021-March 2022), it rose by 43% during the 30-day period leading up to 16 March 2022.

Following this month’s crypto wipeout, this price has dropped by 73% and as of 24 May 2022, MIR is currently trading at $0.4628.

Luckily for Mirror Protocol, UST was not algorithmically linked with it, as it was with Terra Luna. This means that, every time UST depegged, it only affected the minting of LUNA – the Mirror Protocol tokens were unharmed.

According to CoinGecko, Mirror Protocol has a maximum supply of 370,575,000 coins and a circulating supply of 155,638,255 coins. The coin has a current market cap of a little under $73.1m.

How does this information impact a MIR crypto price prediction?

Mirror Protocol price predictions

Remember that while predictions can be useful as an indicator of what might happen to a crypto’s price, they must always be understood as possibilities rather than absolutes.

Gov.capital gives a Mirror Protocol price prediction for 2023 of $0.10175.

DigitalCoinPrice’s Mirror Protocol coin price prediction for 2023 is a more bullish $0.61. The website’s Mirror Protocol price prediction for 2025 stands at $0.79.

WalletInvestor, in a bearish MIR coin price prediction, thinks the coin will be worth just $0.0649 in a year’s time.

Mirror Protocol investment analysis

The latest MIR cost is $3.15. As per this Mirror Protocol analysis, today the investment has a 3.2 out of 10 safety rank and +295.6% expected profit with the price going to $12.45. The dominant ranking factor for this cryptocurrency is Market Cap.

To determine the return that can be obtained from the Mirror Protocol investment in 2022 the system has analyzed the daily rates of the cryptocurrency for the previous 6 months. The character of cryptocurrencies is undulatory, which means that there is a good possibility that MIR can reach near to an all-time high price again in the future.

You can use this Mirror Protocol report to verify if it is worth it to invest in this asset and how trusted or risky this investment could be. Today the analysis tool has graded MIR on the place number 896 out of 4138 cryptocurrencies by the safety rank.

Conclusion

The Mirror Protocol has been working to further its current and long-term objectives. Mirror Protocol’s developers aim to improve usability for Terra and Ethereum users. Fixing initial areas of friction, adding dashboard analytics, and drawing greater liquidity are all part of this effort. As a result, one may conclude that mAssets are here to stay and will continue to grow in the future.

Originally published via this site, this site, this site and this site

Although the material contained in this website was prepared based on information from public and private sources that LCXwire.com believes to be reliable, no representation, warranty or undertaking, stated or implied, is given as to the accuracy of the information contained herein, and LCXwire.com expressly disclaims any liability for the accuracy and completeness of the information contained in this website.