Will the crypto market get weird this Memorial Day weekend because of increased volatility in the market? Is now the time to divest risky investments? Will the Memorial Day Crypto Curse happen in 2022? Is the crypto market at risk of seeing even more significant losses over the traditional three-day weekend? Or will the market see a significant rebound while institutional investors take a three-day holiday? Only time will tell, but leading analysts from the financial research firm Fundstrat are offering suggestions to the average crypto investor. Are you listening or are you still all in?

Altcoins are the most vulnerable, but cryptoassets supported by strong fundamentals should continue to be a good long-term investment. As an altcoin, the LCX Token is at risk, but should an LCX investor be concerned?

Is this the perfect catastrophic storm for crypto?

Head of Fundstrat digital asset strategy Sean Farrell said in a note published Thursday a combination of factors are creating the perfect storm for prices to drop over the weekend. Low liquidity in the crypto market, increasing leverage, and negative macroeconomic factors, including the Federal Reserve’s efforts to tighten monetary policy, could lead to large price swings.

The chill of crypto winter has pushed the top cryptocurrencies to record lows for the year. Bitcoin, the most popular cryptocurrency, was trading at $28,800 on Friday, down more than 38% year to date, and Ether was trading at $1,700, down about 52% since the start of 2021. Both Bitcoin and Ethereum are far off from their record highs in November (Bitcoin is down 58%, Ether 65%).

This weekend could add more pain to the already hurting crypto traders, according to Farrell. On Memorial Day weekends in 2020 and 2021, crypto trading volume declined 43% and 35% respectively, as many institutional traders took the weekend off. This low liquidity could give rise to price volatility again this year.

“The takeaway here is that liquidity is likely to be extremely low this weekend and during most holidays thereafter, which could result in outsized price swings,” Farrell wrote in the report.

Impact of Bitcoin Contracts

Another factor contributing to possible whipsaw weekend prices is the increasing number of futures contracts for Bitcoin. Because these contracts enable investors to bet on the future price of Bitcoin, either up or down, a drastic move in either direction could cause major liquidations, Farrell wrote.

Low liquidity and high leverage, combined with the Fed’s plans to deliver more half-point interest rate hikes in the coming months, could lead to selloffs in crypto.

“Macro is driving everything in crypto right now,” Farrell wrote in the report. “The U.S. remains burdened by rising prices, rate hikes, and QT, which has led to compressions in valuations across all risk assets.”

To protect against the volatility, Farrell said traders could sell any risky lesser-known “altcoins” and purchase near-term put protection, which would temporarily protect against falling prices on any long crypto positions they hold.

Yet despite the increased volatility over the weekend, Farrell said Fundstrat expects crypto prices to increase in the second half of 2022.

Is The LCX Token AT Risk Of The Memorial Day Curse?

With the Memorial Day Curse in mind, the average LCX Token investor can feel confident their altcoin should survive and come out of this crypto winter in a stronger and more profitable position. For a more detailed explanation, please see our previous article, “Crypto Crash, Destruction Creates Extreme Fear, LCX Token As Good Investment With Price Prediction 2022 – 2030”.

LCX Is An Excellent Investment Opportunity

Most investors will find the LCX Exchange is an excellent investment opportunity through the purchase of the LCX Token. If you are not familiar with LCX, now is a great time to start your research and due diligence.

LCX is the Lichtenstein Cryptoassets Exchange and is headquartered in Liechtenstein. Lichtenstein is a German-speaking, 25km-long principality between Austria and Switzerland. Much like another European safe haven, Malta, the government in Lichtenstein introduced Blockchain Act, a well-thought-out regulatory framework, which will provide security for any blockchain-based, or cryptocurrency enterprise.

Monty C. M. Metzger, founder, and CEO of LCX, optimistically announced that they’ll continue to propel fintech and blockchain innovation due to their dedication to developing a new category leader in the crypto industry. Let’s see how $LCX can prove interesting for crypto investors.

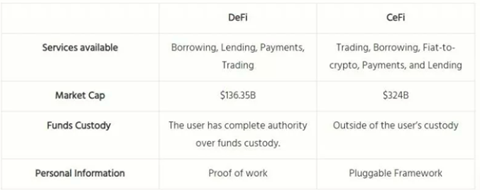

LCX is a CeFi (Centralized Finance) exchange, as contrasted to a DeFi one. Take a look at the distinction between the two:

Source: LCX.com

The LCX ($LCX) is the native token of the LCX.com platform and LCX Cryptocurrency Exchange. The LCX Token aims to encourage various stakeholders to participate in the ecosystem by functioning as a long-term sustainable incentive mechanism.

The LCX Token is an exchange-based utility token that gives all users a piece of the pie when they trade in one of the two cryptocurrencies present on LCX.com, Bitcoin or Ethereum. Users with a certain amount of LCX Tokens can then access premium features not available for other users. The LCX Token is an ERC20 token and can be stored in any ERC20 compatible wallet.

Token Summary

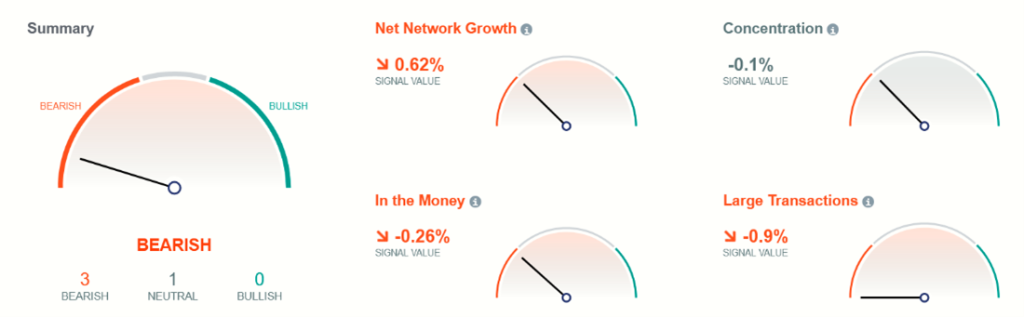

Interesting on-chain metrics that provide a rapid understanding of the state of LCX:

Actionable Signals

Momentum and value signals that will help you better judge the on-chain sentiment of LCX

Where to trade LCX tokens

Uniswap is a decentralized exchange (DEX) for swapping tokens, which uses an automated market maker (AMM) model that allows users to trade against a liquidity pool. While this is obviously a good option to purchase LCX (LCX), we only recommend this platform for advanced users. Due to the fact that this exchange is decentralized, you are liable for any losses due to errors made.

LCX Technical Analysis

LCX has been experiencing lots of selling pressure this month. This pushed prices into oversold territory twice and the market is currently recovering. The price of LCX has been a bit stagnant in the last week as shown by the sleeping William Alligator. Currently, LCX has little momentum increasing to the upside. MACD lining is about to cross the signal line and we, therefore, anticipate the price of LCX to break out to higher prices.

Originally published via this site

Although the material contained in this website was prepared based on information from public and private sources that LCXwire.com believes to be reliable, no representation, warranty or undertaking, stated or implied, is given as to the accuracy of the information contained herein, and LCXwire.com expressly disclaims any liability for the accuracy and completeness of the information contained in this website.