Why does crypto need another layer? Why should you care if Layer-three is implemented or not? The reason is simple if are or plan to invest in or use the crypto marketplace. The existing blockchains are on slow crypto networks causing long processing time and high fees. Both Bitcoin and Ethereum are looking to solve the network load by implementing Layer-two services (If you want a Layer 1 and Layer 2 explanation checkout our previous article “Get A Complete Layer 1 Vs Layer 2 Blockchain List Of 2022 With Crypto Protocols Project Comparison | What’s The Difference”). Layer-three is focused on solving the interoperability issue in the blockchain networks.

In this article we will introduce you to the layered architecture of blockchain networks while exploring the essentials of L3 solutions. We will also look at the top 5 investment worthy Web3 Projects and provide one of the most complete lists of Layer 3 crypto coin list (For a complete list of Layer 1 and Layer 2 projects, read our previous article here).

The Background On Why A Layer 3

As the crypto industry is experiencing surging demand from users, scalability has become an even more important issue.

Since top blockchains like Bitcoin and Ethereum feature limited throughput, improving their scalability is vital to handling the increased network load as congestion often leads to excessively high transaction fees and processing times.

This ends up discouraging many users from using decentralized applications (dApps) and other on-chain solutions. Instead, these users (and many developers as well) move to competing blockchains that feature better scalability by often sacrificing a degree of decentralization or security.

To avoid the above scenario, blockchains with lower throughput aim to solve their issues by improving their scalability via layer-two (L2) solutions.

In the case of Bitcoin, this is the Lightning Network, while there are numerous projects on Ethereum that build L2 services to relieve some stress from the main chain as developers are getting ready to roll out the long-awaited ETH 2.0 upgrade.

For these reasons, scalability solutions built on the second layer of a blockchain have been at the center of the discussion in the crypto community in the past few months.

However, while many projects are just about to launch their L2 solutions on the main chain and integrate them with popular services, others are already developing their products on layer-three (L3) to solve another burning issue of blockchain networks: interoperability.

In this article, we will introduce you to the layered architecture of blockchain networks while exploring the essentials of L3 solutions.

The Case for Multi-Layer Blockchains

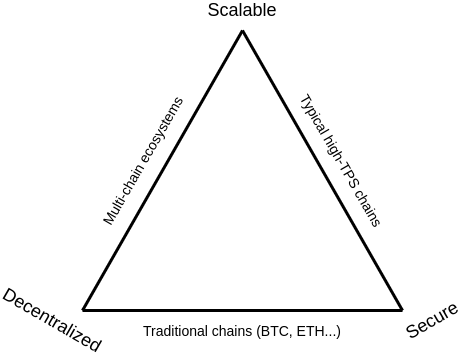

If you have been in the crypto space for a time, then you have probably heard about the blockchain trilemma (also called the scalability trilemma).

Source: //vitalik.ca/general/2021/04/07/sharding.html

Simply put, due to the nature of distributed ledger technology (DLT), existing blockchains can only achieve two of the three qualities below:

- Decentralization

- Security

- Scalability

For that reason, DLT projects must sacrifice one thing to excel in the other two. This means:

- Traditional blockchains like Bitcoin and Ethereum feature rock-solid security and true decentralization by relying on network participants to operate full nodes to validate every transaction. However, this leads to limited scalability and throughput.

- Highly scalable blockchains like Binance Smart Chain and Solana reach a consensus via a limited number of nodes to achieve high scalability and excellent security, which comes with increased centralization.

- Some DLT solutions utilize ecosystems in which multiple interconnected chains (on the first layer) run in parallel to operate dApps. While this comes with high scalability and decentralization, this setup often has caveats in terms of security.

The good news is that the scalability trilemma only poses an issue when DLT projects want to have all three qualities on the first layer (the main chain or L1).

So, while Bitcoin can’t achieve high scalability without sacrificing some of its security or decentralization on L1, it can increase its throughput by implementing a layer-two solution like the Lightning Network that offers near-instant and cheap BTC transactions for users by moving them off the main chain.

Most importantly, layers built on top of a blockchain generally rely on the main chain to finalize transactions. For that reason, while they offer additional benefits for the DLT solution’s ecosystem (enhanced scalability in the case of L2), layer-two and layer-three services still provide the same (or very similar) security and decentralization as L1 transactions.

As a result, the multi-layer structure of blockchains provides an efficient solution to the scalability trilemma, allowing DLT networks to become scalable, decentralized, and secure without sacrificing any of the three critical qualities.

The Blockchain Interoperability Problem

Now that you know the essentials about the layered architecture of blockchains and how L2 solves scalability-related issues let’s look at why we need the third layer.

The blockchain trilemma is not the only fundamental problem that impacts crypto market participants. Interoperability, which refers to the ability to see, access, and exchange information between separate computer systems, is left unsolved by L2 services.

In terms of crypto, interoperability (or cross-chain functionality) means that two blockchains with separate ecosystems (think of Bitcoin and Ethereum) can communicate and interact without any centralized intermediaries.

Natively, it’s impossible to move BTC to Ethereum and utilize the cryptocurrency across multiple decentralized finance (DeFi) apps or vice versa. While projects like Wrapped Bitcoin (WBTC) have built bridges between BTC and Ethereum on the first layer so users can utilize the digital asset with dApps in the smart contract blockchain’s ecosystem, they generally feature trusted intermediaries or some form of centralization (e.g., centralized custodians).

Despite such efforts, dApps reside in their own distinct ecosystems – for example, the lending protocol Aave on Ethereum, the PancakeSwap automated market maker (AMM) on Binance Smart Chain, and the Serum decentralized exchange (DEX) on Solana – and are nearly impossible to access if you hold your assets on another chain without using a centralized third party.

And, while the scalability issues of traditional chains are being solved by L2 solutions, they are expected to fragment the crypto space further (thus, make the interoperability problem even greater).

For example, while the AMMs Uniswap and SushiSwap both reside on Ethereum, they are working to implement separate L2 solutions (Optimism and Polygon, respectively). As a result, to move an ERC-20 token from Uniswap’s L2 to SushiSwap L2, a user would need to transfer a coin from Optimism to Ethereum’s main chain and then to Polygon.

This inefficient process comes with higher costs and much longer processing times, which sometimes take multiple days due to the time some L2 scalability protocols need to finalize transactions.

Considering all this, the lack of interoperability between different blockchains and layer-two solutions has led to a highly fragmented experience, which can significantly hinder the mass adoption of cryptocurrencies and DLT technology.

For that reason, the need for layer-three solutions is greater than ever.

Layer-Three (L3) Solutions: The Key to Achieving Blockchain Interoperability

Layer-three solutions aim to supercharge distinct blockchains with the cross-chain functionality they need to communicate and interact with each other to achieve true interoperability.

It’s important to emphasize that L3 projects seek to accomplish this in a decentralized way without any centralized custodians, intermediaries, or other third parties. For that reason, they must take a distinct approach to fulfill their goals.

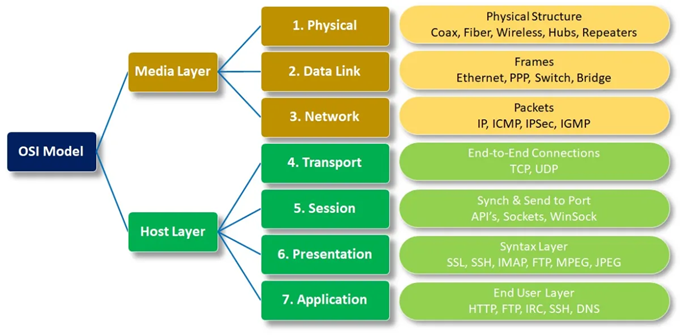

While multiple projects are focusing on providing interoperability between blockchain ecosystems on the third layer, what they have in common is that they seek to create something like the internet’s layered structure.

As you can see in the image above illustrates the Open Systems Interconnection (OSI) model, the internet’s first layer consists of physical devices like coax and fiber cables that provide the backbone for users to connect to the web.

In terms of DLT technology, this is the main chain that hosts the distributed ledger and where consensus between network participants occurs. In general, the first layer provides the security, transparency, traceability, decentralization, and the other benefits of blockchain tech to users along with basic functionalities like peer-to-peer (P2P) coin transfers.

Simply put, the internet’s link-layer and blockchain networks’ scalability layer both have the goal to achieve efficient (data or financial) transactions between directly connected parties (e.g., via the WiFi for the web and Optimism’s L2 service).

Like L1 chains, layer-two solutions feature various qualities that make them distinct from each other. At the same time, services on L2 are usually tied to specific (or multiple but very similar) blockchains (e.g., Optimism is developed primarily for Ethereum while the Lightning Network is specifically created for Bitcoin).

Since there is a close connection between L2 and L1 solutions, it makes great sense to implement interoperability protocols on a separate (third) layer. And this takes us to L3 services.

While L1 and L2 solutions have numerous differences – using various technologies, features, and functionalities to serve users within their ecosystems – layer-three interoperability protocols seek to make all the things that take place in the underlying layers as simple as possible.

By abstracting away these differences, distinct networks and ecosystems can connect, communicate, and interact via an L3 protocol.

In the internet’s case, the Internet Protocol (IP) is responsible for achieving this. While the different devices, applications, and services on the layers below utilize distinct networking technologies, IP can establish communication between them by routing packets of data across various networks.

Layer-three interoperability protocols are meant to work similarly in the blockchain world. However, in addition to data, L3 solutions seek to packetize value and route these value packets across DLT networks.

As a result, they can effectively connect L1 and L2 blockchains as well as the applications and services within without trusting any third parties.

Interestingly, multiple L3 projects are developing interoperability protocols to connect different blockchains and L2 services.

- Interledger Protocol (ILP): Originally launched as a Ripple project, the Interledger Protocol is an L3 solution that implements the standards of interconnectivity on the web into the world of blockchains. Serving the same purpose as the Internet Protocol (IP), ILP packetizes value and establishes value transfers across multiple L2 and L1 chains.

- IBC Protocol: Introduced with the’ Stargate upgrade, the IBC Protocol resides on the third layer of the Cosmos stack as a reliable and secure module that provides interconnectivity between connected blockchains. Dubbed as the “TCP/IP for blockchains,” IBC handles data transportation, authentication, and ordering across numerous chains, such as the Cosmos Hub, IRISnet, Akash, and Crypto.com’s DLT network.

- Quant: Focused primarily on enterprise blockchain networks, Quant connects both public and private chains via its Overledger DLT gateway service and unique solutions, such as multi-DLT smart contracts and multi-ledger tokens. Its partners include businesses like Hyperledger, Nvidia, and Oracle.

- ICON: Featuring partnerships with the likes of Samsung and Seoul’s government, ICON is an interoperability protocol that aggregates all blockchain data into one layer to connect numerous chains under one unified web of interconnected networks.

The Road to Creating the Internet of Value

L3 protocols have great potential and are expected to drastically change how blockchains work in the digital asset industry.

When L3 protocols get implemented across various blockchain networks and L2 scalability solutions, it will eliminate the fragmentation problem of the cryptocurrency industry and unify all the different products and services in a similar way to how the internet works today.

True interoperability will not only lead to a boost in the adoption of blockchain technology and cryptocurrencies but will also allow the industry to go beyond finance.

Potentially, it will lead us to the much-awaited Internet of Value (IoV). This concept envisions an internet where value can be transferred just as easily, cost-effectively, and reliably as data on the web.

And, in addition to money, IoV will allow users to exchange any valuable asset, such as stocks, bonds, commodities, music, intellectual property, art, and scientific breakthroughs.

While the Internet of Value is definitely years away, it will be exciting to see how layer-three protocols will supercharge otherwise isolated blockchain networks with cross-chain functionality to take the industry to the next level.

How To Invest in Web3? The Top 5 Investment Worthy Web3 Projects

The internet is slowly moving towards the blockchain, and this has had an impact on investors who soon saw the impact that the power of decentralized currency is putting in the hands of users. And they have made huge profits by investing in DeFi protocols. As this trend continues to grow, another big area is moving called Web 3.0. Web 3.0 seeks to revolutionize the Internet, just as DeFi is doing the same with the banking industry. Hence, investors are looking for lots of web 3.0 cryptocurrency projects to stay one step ahead of the revolution.

Our Choice For The Top 5 Outstanding, Investment Ready Web3 Projects In 2022

If you’re looking to invest in the Web 3.0 era, consider the following projects:

# 1: Helium (HNT)

Helium is one of the most popular Web 3.0 cryptocurrency projects and has the responsibility of getting the internet into everyone’s hands. The project offers a web service designed to compete with ISP giants like Verizon and AT&T. It uses blockchain along with physical hotspots that allow users to access wireless internet around the world. Users can purchase hotspot hardware that is located in an apartment. If another Helium user wants to connect outside of the building, they can find hotspots and actively connect to them.

This connection method is very beneficial for hardware owners. When someone connects with them, that user will earn HNT tokens. Therefore, providers are encouraged to use hardware in high-traffic areas. In addition, end users will be better rewarded for joining the network and growing the network to become more popular. As more validators and hotspot providers see lucrative opportunities in HNT, end users have more hotspots to connect to.

Helium continues to introduce a number of innovative services by updating the offering from ISPs. Recently the network deployed a group of 5G compatible hotspots to provide the highest possible connection speed.

The network’s native token, HNT, trades at $ 38.4 with a trading volume of $ 33.4 million and a market cap of $ 3.9 billion.

Helium Price Analysis: HNT May Hit Above $18.70 – Cryptocurrency News

# 2: River (FLUX)

While Helium provides basic access to the Internet with its product service, Flux is the project that provides developers with the foundation for building this new version of the web. Flux can be thought of as a sandbox for Web 3.0 development. Users can develop Web 3.0 applications and decentralized projects and then deploy them on networks. This is made possible by FluxOS, a decentralized operating system for Flux users.

Flux invites users and businesses to use FluxOS and the network’s cloud computing capabilities to deliver decentralized applications. The network lists a number of use cases for the services, particularly the Oracle hosted services that aggregate data from across the blockchain web. It is described as the Web 3.0 version of the Amazon Web Services offerings.

Flux gets a lot of attention because it uses a proof-of-work consensus mechanism. Of course, proof of work is becoming increasingly rare in the blockchain world. Cryptocurrency mining has come under scrutiny because of its energy consumption, but it is also an opportunity for users to reap the rewards of having compatible hardware for mining new coins. Users can break down FLUX with computer graphics processors (GPUs), with new data blocks being generated in the throughput network every two minutes.

It became particularly lucrative during the FLUX price boom. The network is continuously expanding its product range and has recently introduced 30 dApps into the network at the same time. The FLUX price hit an all-time high of $ 2.89, posting a gain of more than 14,000% over the year.

At press time, FLUX is trading at $ 1.87 with a trading volume of $ 14.5 million and a market capitalization of $ 413 million.

FLUX – FLUX Price, Charts, All-Time High, Volume & Markets – In USD, EUR, CNY etc. | Nomics

# 3: Filecoin (FIL)

Filecoin is like a filing cabinet for Web 3.0. It is a decentralized storage network that serves both as a secure alternative to centralized cloud storage and as a passive way of making money.

Filecoin wants users to be aware that the storage can hold almost any type of data, be it audio files, videos, still images, or text. It also claims to be secure enough for more important data like private company information and records.

On the investor side, they are rewarded for the provision of storage capacities. Anyone can make storage space available to Filecoin users; This is how the network creates competitive tariffs. The provider can provide the network with unused hard drive space to store other people’s data. The sellers then passively earn the FIL. Of course, the more storage a user provides, the more FILs they earn.

FIL is trading at $ 53.4 with a trading volume of $ 493 million and a market capitalization of $ 6.9 billion.

Filecoin – A decentralized storage network

# 4: Polkadot (DOT)

Even if you are new to Web 3.0, you have probably heard of the Polkadot Network. With a market capitalization of over $ 35 billion, DOT is the ninth largest cryptocurrency on CoinMarketCap. It is also the network that leads the way into the Web 3.0 era thanks to its rigorous efforts to usher in a fully decentralized Internet through parachains.

In fact, polkadot parachains are very popular with developers. In contrast, developers have to “fight” for their own chain through parachain auctions. Currently only 100 parachains are supported and it is only open to developers. The first Parachain auctions started in early November, with 10 projects competing for crowdfunding. After the first auction, Acala was the winner with over $ 1.3 billion DOT.

In addition, Polkadot is a popular Web 3.0 game of the project that knows how to take care of its projects. The network spends nearly $ 1 billion in assets to fund the development of projects.

DOT is trading at $ 35.9 at press time with a trading volume of $ 1.1 billion and a market capitalization of $ 35.5 billion.

Polkadot (DOT) Logo Vector (SVG, PDF, Ai, EPS, CDR) Free Download – Logowik.com

# 5: Kusama (KSM)

Investing in Kusama is a detour via polkadot. Because Kusama only exists as an experimental network of Polkadot. The developers call it the “canary net”, an allusion to the story of the canary in a coal mine. Think of Kusama as a pimple and a shovel in Web 3.0 development.

Kusama has set up and carried out many projects because the network is the benchmark for the success of Parachains. Developers use Kusama to solve problems related to their projects; Kusama exists for Polkadot to find the bugs and fix them before full release. Just like polkadot, projects compete for a spot on the Kusama network through parachain auctions. After a project wins, Kusama will use it as a training ground before moving to Polkadot. Users can use Kusama applications normally, and developers can find and fix any bugs or inconsistencies before moving to Polkadot and getting wider distribution.

Kusama may be a better short term investment bet as the network is older and stronger. However, Polkadot is sure to catch up as it continues its auctions and raises billions of dollars for crowdfunding.

The network’s native token, KSM, trades at $ 369.4 with a trading volume of $ 108 million and a market cap of $ 3.1 billion.

As always, this is not financial advice but helps identify potential cryptocurrency you may want to research and invest in. To help you with your research, we compiled a Layer 3 Crypto Coins List (We looked and couldn’t find one so researched and created that list for you). Here’s the list and a downloadable PDF is at the bottom of the page.

Layer 3 Crypto Coins List

(Note; this list is as complete as possible based upon our research. New projects and coins are frequently created and old projects and coins collapse.)

| 1 | Helium (HNT) |

| 2 | Chainlink (LINK) |

| 3 | FileCoin (FIL) |

| 4 | Audius (AUDIO) |

| 5 | Flux (FLUX) |

| 6 | Theta (THETA) |

| 7 | ZCash (ZEC) |

| 8 | LivePeer (LPT) |

| 9 | Kadena |

| 10 | Kusama |

| 11 | Polkadot (DOT) |

| 12 | BitTorrent (BTT) |

| 13 | The Graph (GRT) |

| 14 | Stacks (STX) |

| 15 | Basic Attention Token (BAT) |

| 16 | Arweave (AR) |

| 17 | Siacoin (SC) |

| 18 | Nervos Network (CKB) |

| 19 | Ontology (ONT) |

| 20 | Ocean Protocol (OCEAN) |

| 21 | Storj (STORJ) |

| 22 | Hive (HIVE) |

| 23 | Golem (GLM) |

| 24 | Ethereum Name Service (ENS) |

| 25 | Braintrust (BTRST) |

| 26 | Render Token (RNDR) |

| 27 | Casper (CSPR) |

| 28 | NuCypher (NU) |

| 29 | Chromia (CHR) |

| 30 | Nervos Network (CKB) |

| 31 | Conflux (CFX) |

| 32 | Civic CVC) |

| 33 | Steem STEEM) |

| 34 | XYO (XYO) |

| 35 | NKN (NKN) |

| 36 | Reef (REEF) |

| 37 | Orchid (OXT) |

| 38 | Aragon (ANT) |

| 39 | API3 (AP13) |

| 40 | Fetch.ai (FET) |

| 41 | iExec RLC (RLC) |

| 42 | Radicle (RAD) |

| 43 | Band Protocol (BAND) |

| 44 | Marlin (POND) |

| 45 | Mask Network MASK) |

| 46 | Litentry (LIT) |

| 47 | Gitcoin (GTC) |

| 48 | AIOZ Network (AIOZ) |

| 49 | Handshake (HNS) |

| 50 | Elastos (ELA) |

| 51 | Syntropy (NOIA) |

| 52 | Akash Network (AKT) |

| 53 | DIA (DIA) |

| 54 | district0x (DNT) |

| 55 | Kin (KIN) |

| 56 | PARSIQ (PRQ) |

| 57 | Streamr (DATA) |

| 58 | Tellor (TRB) |

| 59 | Somnium Space Cubes (CUBE) |

| 60 | KILT Protocol (KILT) |

| 61 | StackOs (STACK) |

| 62 | MAPS (MAPS) |

| 63 | VIDT Datalink (VIDT) |

| 64 | Numbers Protocol (NUM) |

| 65 | BEPRO Network (BEPRO) |

| 66 | FOAM (FOAM) |

| 67 | Ethereum Push Notification Service (PUSH) |

| 68 | Exeedme (XED) |

| 69 | Modefi (MOD) |

| 70 | Stratos (STOS) |

| 71 | PolkaBridge (PBR) |

| 72 | suterusu (SUTER) |

| 73 | Big Data Protocol (BDP) |

| 74 | Crust Network (CRU) |

| 75 | ACENT (ACE) |

| 76 | Torum (XTM) |

| 77 | Raze Network (RAZE) |

| 78 | Bloom (BLT) |

| 79 | DAOstack (GEN) |

| 80 | Gari Network (GARI) |

| 81 | X Protocol (POT) |

| 82 | Lost Worlds (LOST) |

| 83 | Metaverse Index (MVI) |

| 84 | GameYoo (GYC) |

| 85 | Minds (MINDS) |

| 86 | Aircoins (AIRX) |

| 87 | TrustFi Network (TFI) |

| 88 | ShibaMask (SHBMA) |

| 89 | Aragon Court (ANJ) |

| 90 | Altera (AEN) |

Download the 2022 Layer 3 crypto coin list HERE

Originally published via this site and this site

Although the material contained in this website was prepared based on information from public and private sources that LCXwire.com believes to be reliable, no representation, warranty or undertaking, stated or implied, is given as to the accuracy of the information contained herein, and LCXwire.com expressly disclaims any liability for the accuracy and completeness of the information contained in this website.

About LCXwire

LCXwire is dedicated to providing you the latest news about the products and services of the Liechtenstein Cryptoassets Exchange, the LCX token, and information relevant to the Centralized and Decentralized Finance (CeFi and DeFi) Exchanges. Our goal at LCXwire is to provide you with the best, most relevant and exclusive information about the crypto industry.

Follow us: Facebook I Facebook Groups I LinkedIn I Twitter