The crypto market continues to be extremely volatile, the Greed and Fear Index is at one of the lowest points ever. The fall of Bitcoin has even ended a few marriages from what we read. With the greater than 70% decline in the proce of Bitcoin, is it time to say Bitcoin is dead? Can Bitcoin price possibly reach $0? Will Bitcoin kill all altcoins? One altcoin, and crypto exchange we have been watching has been the LCX Token and LCX Exchange. So what do the experts say about the long-term prospects of LCX? After all, LCX has been one of the better performing altcoins over the past year. See how these articles pull the information to help you form a more informed decision. Is it time to panic?

Bitcoin is dead? Will BTC go up again? Here’s what experts and trends suggest

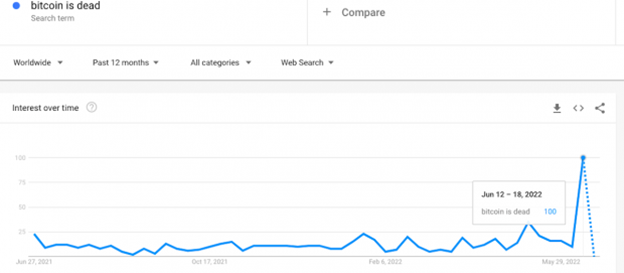

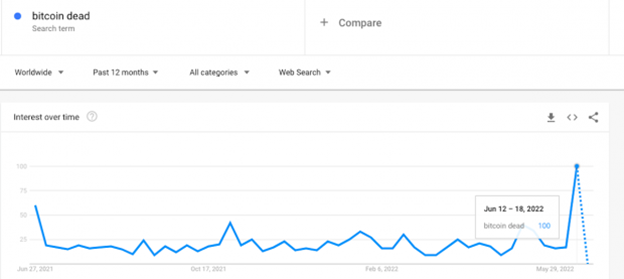

Google search for phrases ‘Bitcoin is dead’ and ‘Bitcoin dead’ has spiked in the last few days with critics claiming the top cryptocurrency will never recover. The last two weeks have been brutal for Bitcoin as its price dropped below $18,000.

According to the Bitcoin Obituaries list on 99bitcoins.com, the top cryptocurrency has died 455 times till now. In 2022, BTC has been already declared dead 15 times with the latest obituary written by Euro Pacific Bank owner Peter Schiff who predicted “Bitcoin will not recover”

“Long-term Bitcoin #HOLDers aren’t worried as they’ve been through 73% declines before. But previous declines didn’t involve anywhere near the total market cap lost during this decline, nor did they involve massive leverage. This crash is just beginning. #Bitcoin will not recover,” Schiff tweeted on 18th June.

However, Bitcoin has once again reclaimed the $20,000 perch, which Schiff thinks is nothing to get “excited about”.

“Don’t get excited about #Bitcoin being back above $20K. 20 is the new 30. This is just another bull trap. Nothing drops in a straight line. In fact, this slow motion crash has been extremely orderly. No sign yet of any capitulation that typically forms a bear market bottom,” Schiff tweeted again on Monday (20th June).

At the time of writing, 11.57 am, India time, Bitcoin was trading at over $21,000, up around 6% in the last 24 hours, while several other altcoins showed recovery.

Bitcoin price recovery over the last two days is primarily due to a push from buyers looking to own the cryptocurrency at a cheaper price. However, BTC trading charts show it is still on a downward slope.

Crypto industry experts in India suggest that BTC may fall below up to $17,000 if the current buying momentum weakens.

“Bitcoin rallied for another consecutive day after recapturing the US$20,000 mark on Monday. Despite the gains, BTC remains on a downward slope and has lost nearly 22% over the past seven days. BTC’s resistance now lies at US$22,000; if the buying strength drops again, we may see BTC falling back to the US$17,000 level,” Edul Patel, CEO and Co-founder, crypto investment platform Mudrex said.

Experts suggest the recovery of the last two days cannot yet be termed as a bullish trend as the crypto markets continue to remain in the “extreme fear” zone.

“Bitcoin recovered back by nearly 9% in the last couple of days and edged above $20K. The market sentiment continued to remain in the “extreme fear zone”. The buying momentum picked up in the last 2 days with the market recovery. However, it is too early to call it a bullish trend reversal,” analysts at WairX Trade Desk shared in a note.

“On the daily time-frame, the BTC trend has formed a descending channel pattern. The next key support for Bitcoin is expected at $14,000. BTC needs to continue its momentum in upwards of $30,000 for the trend to be considered as a bullish reversal,” they added.

Meanwhile, worldwide Google Trends (GT) data suggest the search for ‘Bitcoin Is Dead’ and ‘Bitcoin Dead’ skyrocketed between June 12-18, the days when crypto markets witnessed another round of a massive crash, just a month after the shock crash following Terra (LUNA) debacle.

Source: Google Trends (21-06-2022)

Source: Google Trends (21-06-2022)

Bitcoin has survived after being written off or declared dead, hundreds of times in its brief history. It remains to be seen what the future holds for the top cryptocurrency.

We all know how volatile and unpredictable the cryptocurrency market can be. One month a coin could be at the height of its value, and the next, it could have almost no value at all. Unfortunately, this is simply the name of the game when it comes to crypto. But what would happen if the market’s oldest and most valuable asset, Bitcoin, dropped to zero?

Bitcoin’s Volatility

Because Bitcoin isn’t a stablecoin and therefore isn’t pegged to any real-world asset, it can be just as susceptible to crashes as many of the other cryptos in the industry. If you follow Bitcoin and its price, you’ve likely seen that there’s often no knowing what will happen next. Many investors never see a crash coming, and this is why putting money into crypto can be dangerous.

Bitcoin saw its peak price of around $67,000 in November 2021, but it has been tumultuous since this all-time high. Bitcoin saw a big crash in early 2018, then another in May 2021, and then another in the same month that it reached its peak value. And the trend certainly continued in 2022.

So, it’s safe to say that even the biggest coins can crash just as quickly as any other. But what if a crash took place that took Bitcoin’s price all the way down to zero? Is this possible, and what would happen if such an event occurred?

Wife Leaves Husband After He Refused to Sell Bitcoin at $60K and Bought the Dip

According to a post on Reddit, a user named “Parking_Meater” gave his particular testimony on how the bitcoin (BTC) bull-run ended up hurting his marriage. His wife left the house as he didn’t agree to sell the BTC when prices posted the new all-time high at that time.

In fact, Parking_Meater was caught by his wife adding more money to his bitcoin position. He detailed how the marital situation worsened in a matter of minutes:

“She just left to go stay at her sisters. She is super mad that I didn’t sell at 60k and looks at the price often scolding me. I keep telling her we don’t need the money and have the cash. We live nice. However today she caught me buying the dip and was so pissed she almost hit me! Now she packed bags and went to her sisters to stay. She said not to talk to her”.

So far, the Redditor hasn’t disclosed the total amount of cryptos traded during the infamous “buy the dip” transaction that provoked his wife’s anger.

Story Attracted More Jokes Than Words of Support

When BTC crossed the $60K threshold on March 13, the quote managed to exchange hands circa $61,318. Afterward, bitcoin plummeted over 15% since then. As usual, in most Reddit threads, Parking_Meater’s particular story wasn’t exempt from comments joking about the situation.

One user suggested he should “save a few sats for the divorce lawyer.” Another one even told him that “bitcoin mooning can be a wife changing event.”

Although Parking_Meater ended up his brief testimony by asking help to the community in finding “a good place to pick up girls” in his Lambo, it seems like nobody read that sentence, as one user suggested.

Can Bitcoin’s Price Drop to Zero?

It is technically possible for any cryptocurrency’s price to crash to zero, as seen with the Terra Luna price crash. But, for something as popular and valuable as Bitcoin, some huge shifts would need to take place to allow for such a catastrophic loss of value. It’s important to understand Bitcoin’s functionality to understand why this is the case.

Bitcoin is often bought as a long- or short-term investment plan. Some like to buy it when the price dips in anticipation of another increase and then sell it once it occurs. Others buy Bitcoin with the intention of holding onto it for much longer, despite the crashes and hikes that may follow their purchase.

But there are individuals who believe Bitcoin (or another crypto) will replace traditional tender one day. These crypto enthusiasts often believe that centralized banking is dangerous or unfair and that decentralization is the future. For a person who holds such a belief, the purchase of Bitcoin goes beyond just an investment. It speaks to their passion for cryptocurrency.

And now, Bitcoin can also be used to buy goods and services in various countries worldwide. Some nations have even adopted it as a national tender! El Salvador adopted Bitcoin as legal tender in 2021 (with very mixed results), with other countries even developing cryptocurrencies for citizens to use as a payment method.

Additionally, it would be incredibly hard to dissolve the entire Bitcoin network, even if it became highly restricted or illegal in the majority of countries worldwide. With over 100,000 active nodes on the Bitcoin network spread around the globe, it would take the loss of faith or interest of these nodes for the blockchain to be truly destroyed.

Destroying Bitcoin wouldn’t be the same as taking down a website. Its complex infrastructure, along with its decentralized nature, gives it a strong foundation that isn’t easy to destabilize, even if you are a powerful government.

What’s more, big players in the crypto industry can have a huge influence on the price of Bitcoin. Known as crypto whales, these individuals or groups own huge amounts of cryptocurrency, allowing them to manipulate the market when they deem it necessary. If these whales don’t want Bitcoin to fall to zero, they can prevent this from happening in certain scenarios.

These factors all make a total Bitcoin crash very, very unlikely. But there are other influences at play that put Bitcoin’s value in danger.

What Puts Bitcoin’s Price at Risk?

One of the biggest arguments used by those who don’t support Bitcoin is that it isn’t backed by any kind of physical asset. Additionally, some say that it doesn’t yet have enough prevalence in the traditional economy to succeed. Of course, your country’s national currency is likely still a lot more versatile in your day-to-day life than Bitcoin when it comes to buying goods, meaning it has more of a practical use than the latter.

Bitcoin’s continued struggle with scalability is also putting its future at risk. As more and more individuals invest in bitcoins, the transaction load on the blockchain increases. This creates something called latency, wherein it takes a long time for each transaction to be verified by miners. Because Bitcoin’s block size is pretty small, the blockchain can only process a limited number of transactions every minute. Many see this factor as Bitcoin’s Achilles heel.

A range of other factors also affect Bitcoin’s price. Even a simple tweet from Tesla and SpaceX CEO Elon Musk caused a crash in 2021, so it’s safe to say that Bitcoin is not a stable asset.

It’s also important to remember that, above all, Bitcoin is an asset driven by demand and not much else. This also makes it incredibly volatile.

So, let’s say Bitcoin’s price did somehow fall to zero. What effect would this have on the market?

What Would Happen if Bitcoin’s Price Dropped to Zero?

Let’s imagine that one day, every country in the world illegalized the trading, mining, and spending of Bitcoin, and its price crashed to zero. While the network itself could still remain intact, such a drop would still cause monumental financial losses for millions of individuals worldwide. There would be no way to sell Bitcoin back to exchanges, as they would be legally required to de-list it for trading. In short, Bitcoin investors who hadn’t already cashed out would be in an impossible situation.

Moreover, the total crash of Bitcoin would send huge waves through the crypto mining industry. The Bitcoin mining market alone is mammoth in size, with many relying on it to make a living. With Bitcoin no longer having any value or use, mining rewards would fall to nothing, and almost a million miners would be forced to find another revenue stream. Mining farms would also have to close, causing the unemployment of thousands.

Hundreds of other companies would also be affected, including those who deal in Bitcoin payments, lending, or swapping. In short, the total crash of Bitcoin would be devastating to millions.

If Bitcoin were to crash in this way, it would likely result in the crash of many other cryptocurrencies. After all, if investors see that the crypto market’s biggest coin has lost all value, chances are many will cash in as soon as possible and off-load their crypto to avoid further losses. All in all, if Bitcoin goes down, many other cryptos will probably follow.

A Total Bitcoin Crash Isn’t Likely to Happen Any Time Soon

There’s no doubt that Bitcoin’s price dropping to zero would have a catastrophic effect on the crypto industry. However, the chances of Bitcoin suddenly crashing in this way are extremely low. Though certain factors could decrease Bitcoin’s value over time, it would take some huge economic and governmental changes, not to mention the destruction of the Bitcoin network itself, for Bitcoin to fall to zero in a short period.

Furthermore, although a Bitcoin crash to zero would be damaging, the impact on wider impact on global financial markets is also worth considering. Expert opinion on this subject varies, with some speculating that Bitcoin and cryptocurrency price crashes would have little impact. However, when you consider that some of the biggest cryptocurrency firms, like Crypto.com, Binance, and BitPay, all have sponsorship deals with companies (typically relating to sports), there is little doubt that at least damage would occur.

How much damage? Who knows. In 2022, when the Terra Luna price crashed, there was almost zero reaction from global financial markets. Bitcoin, however, would likely be a different story.

Bitcoin was the first and every other cryptocurrency came from it. Will Bitcoin survive? Will altcoins survive? This has been a heated debate with one side predicting the demise of the other. Bitcoin maximalists claim that we are heading to Bitcoin dominance and that altcoins are dying, urging the people to sell their positions in other crypto assets to put it all in Bitcoin. In a tweet last year, Charlie Lee wrote: “Some self-proclaimed Bitcoin Maximalists, are Bitcoin Extremists. They think all other coins are scams and will go to zero. Maximalists think Bitcoin is and will remain the dominant cryptocurrency, but there is room for altcoins to exist and even do well. What are you?”

In 1994, Umberto Eco wrote that the Macintosh was Catholic, and that DOS was Protestant. Bitcoin and other cryptocurrencies have a lot in common with religions and have developed their own belief systems. They all share faith in the value and power of decentralization. But just like different religions, every cryptocurrency is on its own path to the truth.

Like Orthodoxy in some religions, people tend to become extreme and intolerant to any other faith and deviation from the original.

In the cryptocurrency world, these people are called “maximalists”. A maximalist is a person that has extreme views and is not prepared to compromise. In his tweet Ver, a Bitcoin Cash evangelist, posted a picture of two identical sides, where “ours” has only good attributes, and “theirs” is shit.

Religions give us some clues as to how these ecosystems will evolve. Yet, there’s not one truth in the path to enlightenment. Bitcoin’s dominance is unquestionable, it’s eight times bigger than Ethereum, the second cryptocurrency.

But the fact is that as blockchain and cryptocurrency technology develops, we’re going to see many alternatives. As different cryptocurrencies make technology choices and trade-offs, trying to solve problems, we will see different coins occupy different niche markets. Even at the top it’s it’s going to be crowded, with at least two or three competitors in every application you can imagine.

We’re not going to end up with one system that does everything. That doesn’t make sense with this technology.

When you look at the evolution of cryptocurrencies, initially we had one, Bitcoin. Since we’ve seen the appearance of hundreds of coins, now thousands and in the future, we will even see tens of thousands. The growth of new blockchains and tokens, doesn’t seem to be slowing down. In the last decade a thousand coins died, while close to 3,000 are still in existence.

You can expect to see more failures and initiatives come and go, just like we saw in the 90s dotcom market. But this is great from a technology perspective because it only contributes to the evolution of the industry. Keep in mind that just because there are many alternatives, it doesn’t mean that every coin listed on Coinmarketcap.com is worth looking at or even buying.

In the crypto market there are no barriers that would stop someone from building something different or allow someone to build a monopoly. That’s one of the great aspects of this market, its openness. There is one big difference between crypto and religions. It is difficult to be a member of multiple religions, but it very easy to use multiple cryptocurrencies. Competition to create the best cryptocurrency has sparked an evolution that led to forks and new coins, birthing new things like #Ethereum, #Litecoin, Bitcoin Cash, #Bitcoin SV, Bitcoin Gold, #IOTA, #Ripple, #Stellar to name a few.

The idea that an environment of multiple competing cryptocurrencies is undesirable, is just wrong. While Bitcoin has clearly outperformed most cryptocurrencies, to expect that this will always be the case strikes me as stupid.

Cryptocurrencies keep on increasing because of our desire for constant improvement. Having several thousand cryptocurrencies isn’t a bad thing. Each represents a solution to a different problem.

While many are still ahead of their time, as technologies and communities mature, they will begin to disrupt industries like never before. IOTA, which uses a blockchain-like variation, is working to connect IoT devices. Using this network, your car will be able to interact with sensors and devices all around the city you live in. The “Ethereum Virtual Machine” (EVM) can run smart contracts that represent financial agreements, employment contracts, and act as trusted escrow for the purchase of high value items.

Even if some coins don’t stand the test of time, they will surely influence the direction of cryptocurrencies to come. We love some and hate others. Freedom offers choices and this is what cryptocurrency is all about.

While long-term gains could happen, not all forecasters are positive on LCX in the short run

What is LCX Token (LCX)?

LCX Token is the ERC-20 cryptocurrency of the Liechtenstein-registered LCX trading platform. LCX can be used to pay all fees associated with LCX’s services. These include exchange fees, custodial fees, decentralised exchange fees and token sales. The LCX Token grants holders certain benefits, including up to a 50% reduction in trading fees, and access to advanced features on the LCX Terminal platform.

LCX was incorporated in 2018 before launching its exchange in 2020. In 2019, chief executive officer Monty C. M. Metzger announced LCX’s membership at the Centre for the Fourth Industrial Revolution of the World Economic Forum.

On January 2022, hackers stole nearly $8m in funds after an LCX hot wallet was compromised. In a 7 June update on the situation, LCX mentioned that 60% of stolen funds were successfully frozen following a Liechtenstein court order.

In the following guide, we break down the key features of this platform before assessing the LCX Token price prediction. What is LCX Token and should you invest today in the LCX coin? Keep reading to find out.

Components of the LCX ecosystem

In addition to the regulated LCX Exchange, LCX comprises a host of tools and platforms for cryptocurrency traders.

LCX Terminal: This multi-exchange cryptocurrency trending platform allows users to link up to 16 exchanges on a single interface. LCX Terminal is compatible with a range of top-tier exchanges.

Screenshot of exchanges available on LCX Terminal

LCX Terminal aggregate of top-tier and second-tier exchanges – Source: lcx.com

LCX Token Sale Manager: This is a fully compliant token-issuance solution supporting smart contract development, investor on-boarding, know-your-customer (KYC) integrations and further regulatory assistance.

Screenshot of various tools available on LCX Token Sale Manager

Legal tools available on the LCX Token Sale Manager – Source: lcx.com

LCX Mobile: The mobile application that lets you buy, sell and trade cryptocurrencies on your smartphone.

STO Launchpad: A technology platform for issuing tokenized securities. Tokenized securities allow for the transferral of rights and ownership of physical assets over the blockchain.

LCX Smart Order: This provides a routing system for cryptocurrency trading in real time. The algorithms are designed to find the optimal price for digital assets by seeking out the best bid and ask prices on the centralized exchanges. LCX Smart Order also allows for arbitrage trading opportunities.

LCX offers other features, including pricing oracles, the offline, cold storage LCX Vault, and even a decentralized exchange.

LCX Token: Key details

The LCX token generation event (TGE) occurred in March 2019, when one billion tokens were deployed on the Ethereum blockchain. Following a token burn, the maximum supply was reduced by 50 million.

The company retains 10.5% ownership of the LCX coin supply, vested until June 2023. All other tokens are in public hands. Additional details of the initial supply allocation have not been disclosed by LCX. Currency.com has asked for details on the official Telegram channel.

As of 21 June 13:30 BST (UTC +1), LCX was trading at $0.096 with a circulating volume of 757,401,119. A 24-hour trading volume of $8.02m amounted to 10.6% of the $73.12m market capitalization. LCX is primarily traded on the Coinbase and Liquid centralized exchanges, as well as the Uniswap decentralized exchange.

LCX downtrended throughout the first quarter of 2022. Having opened the year at $0.175, it fell to what was a daily high of $0.167 on 25 March and continued down to a daily low of $0.049 on 12 May.

The token traded sideways until 9 June, when LCX saw a 37% upshot in a single day. The latest trading value of $0.096 was 42.5% below the 90-day high of $0.167 observed on 25 March. Now, let’s take a look at the LCX Token crypto price prediction.

LCX Token price prediction

Going by the TechNewsLeader LCX Token price prediction, the cryptocurrency could fall in value in the short term. LCX could be trading at $0.083 by the end of 2022 before a reversal. The forecaster’s LCX Token price prediction for 2025 is $0.24, before heading up to $1.44 in 2030.

PricePrediction offers a bearish LCX Token price prediction for 2022 of $0.069. The forecaster does expect a reversal in the long term. The LCX Token coin price prediction target for 2025 is $0.19 while the LCX Token price prediction for 2030 is $1.24.

At DigitalCoinPrice the 2022 LCX price prediction target is $0.12 and the 2025 target for $0.18. The token could reach $0.42 in 2030, according to the forecaster’s coverage.

The WalletInvestor LCX Token price prediction is quite bullish, giving a 2022 target of $0.17. According to the forecaster, LCX could trade as high as $0.37 by December 2025.

Collating the LCX price predictions among four online forecasters suggests that the token will remain relatively flat throughout 2022, possibly generating 14.5% returns for today’s investors. By 2025, LCX could generate a 178% return on investment. By 2030, the token could net returns of 972%, according to the digital forecasters.

Please note that the price forecasts provided in this article are speculative and should not be taken as genuine financial advice. Currency.com recommends conducting your own research into LCX, or any other project you are considering making an investment into.

FAQs

How many LCX Tokens are there?

There are currently 757,401,119 LCX in circulation against a maximum supply of 950 million.

Is LCX Token a good investment?

Some LCX Token price predictions expect a short-term fall in value, although long-term projections are more positive. Additional research should be undertaken before opening a position.

Will LCX Token go up?

Some LCX Token price prediction targets are bearish, while others expect generous returns in the long run. These targets should not be taken as genuine financial advice. Always do your own research before investing.

Should I invest in LCX Token?

You should make your own conclusions following a deep analysis of the project and only after receiving independent financial advice. If you do make an investment, make sure to never part with more money than you can afford to lose.

Originally published via this site, this site, this site, this site and this site

Although the material contained in this website was prepared based on information from public and private sources that LCXwire.com believes to be reliable, no representation, warranty or undertaking, stated or implied, is given as to the accuracy of the information contained herein, and LCXwire.com expressly disclaims any liability for the accuracy and completeness of the information contained in this website.

About LCXwire

LCXwire is dedicated to providing you the latest news about the products and services of the Liechtenstein Cryptoassets Exchange, the LCX token, and information relevant to the Centralized and Decentralized Finance (CeFi and DeFi) Exchanges. Our goal at LCXwire is to provide you with the best, most relevant and exclusive information about the crypto industry.

Follow us: Facebook I Facebook Groups I LinkedIn I Twitter